Research Updates

Commodity Blenders reaches out to university-based scientists to cover recent advances and key developments in animal nutrition and health. Our Research Updates provide useful, concise, non-commercial insights from leading dairy and animal researchers in the U.S. and Canada.

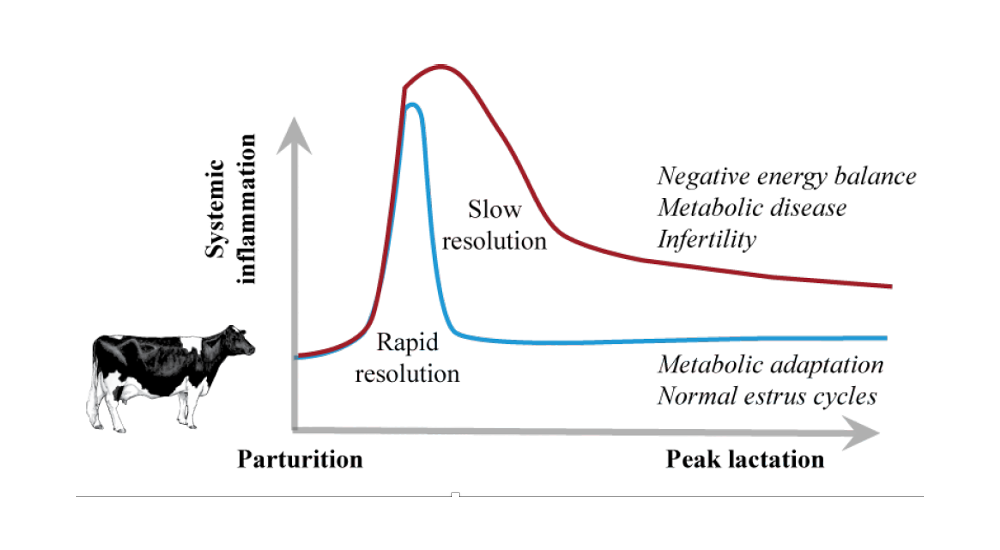

Resolving Post-Calving Inflammation ASAP

For most heifers and cows, the natural and necessary inflammation associated with calving resolves within the first few days of lactation. But for a minority, transition inflammation may persist and quickly become costly — lost milk production, increased disease, lower fertility. Michigan State’s Dr. Barry Bradford answers: What can you do at the herd level — nutritionally and cost-effectively — to support speedy resolution of post-calving inflammation?

Formulating for Better AA Efficiency

How to optimize milk protein yield, improve cost efficiency, and reduce nitrogen excretion? The answer: Balance dairy rations for essential amino acids (EAA) rather than their aggregate, metabolizable protein (MP). Canada’s Dr. Hélène Lapierre and U.S. researchers updated the NASEM 2021 guide to MP and EAA, which now recognizes requirements and “efficiency of utilization” of individual EAA.

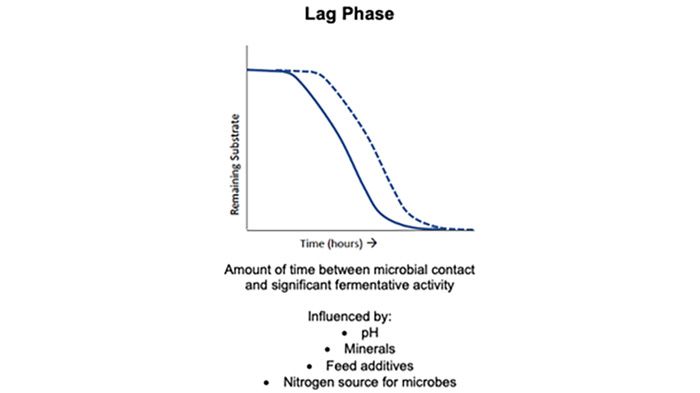

Fiber: Priority for Analysis

Fiber is the top analytical priority, especially forage fiber,” says Ohio State’s Dr. Benjamin Wenner. Why? First, because of its high proportion in the diet. Also, its leading role as a substrate for rumen microbial protein and VFA production. And, it impacts how other dietary components — like minerals — affect rumen microbial activity and fiber digestibility. A closer look at the three main in-vitro digestibility analyses — fiber, starch, protein — can support more cost-efficient diet formulation decisions.

Protein for Transition

Protein for Transition

In high-producing dairy cows, a top priority is accurately meeting — but not exceeding — energy needs. However, toward the end of gestation, cows also mobilize amino acids (AA) from available protein sources, including skeletal muscle. Purdue University’s Dr. Jackie Boerman suggests AA dietary support for muscle in dry cows and during early lactation may be economical insurance for a strong transition.

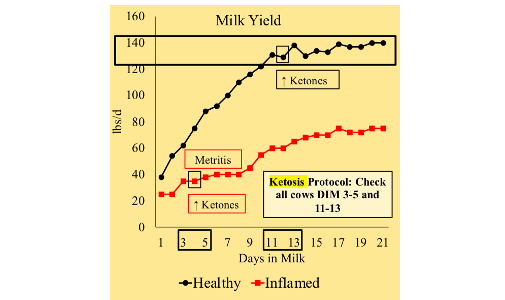

Rethink Transition Ketosis

Why? Because changes in circulating NEFA, ketones, and calcium actually support high milk yield in healthy, high-producing cows. “Don’t mess with high production,” says Dr. Lance Baumgard of Iowa State University.

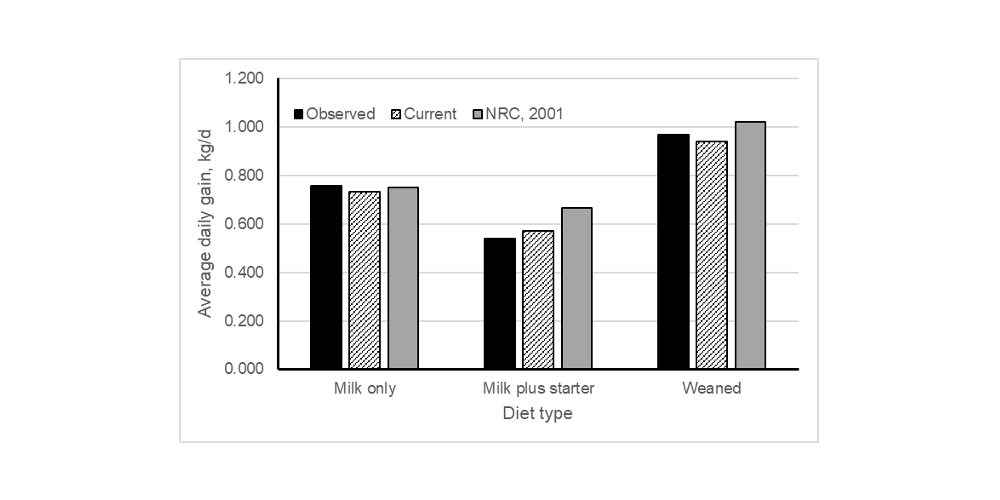

Changes for Calf Diets

Take a closer look at dietary energy for young calves, says Dr. Jim Drackley of the University of Illinois. New dairy nutrition modeling (NASEM 2021) enables more accurate prediction of growth in calves fed milk and milk replacer across a wider range of management systems. Think “energy-allowable growth.”

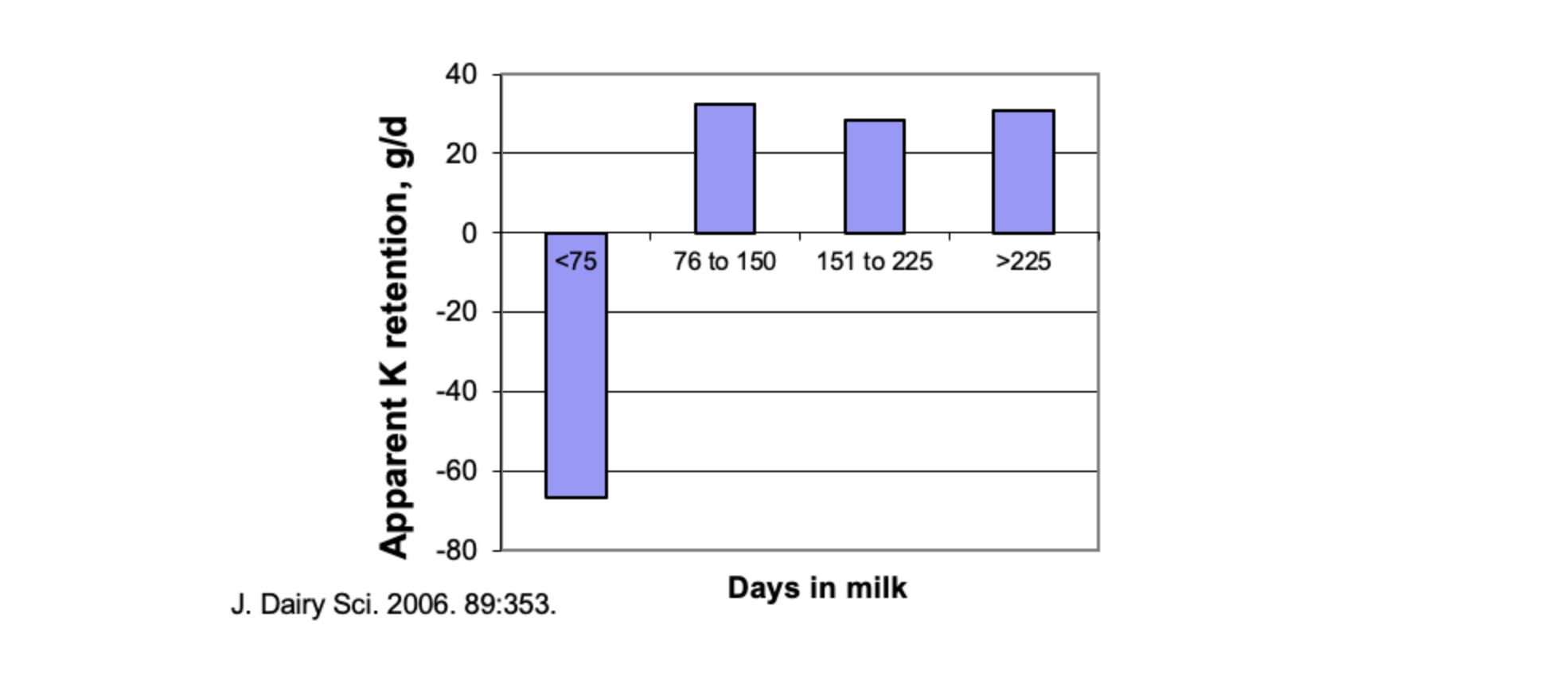

Summer DCAD: The K Source Option

Potassium (K) plays a key role maintaining the dairy cow’s blood acid-base balance while supporting many other vital functions. We especially want to avoid negative K balance during lactation. Dr. Tom Jenkins, Emeritus Professor at Clemson, zeroes in on K in DCAD to support summer milk fat.

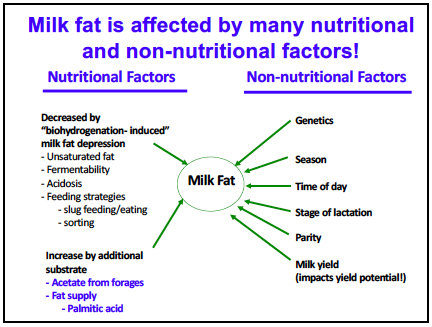

Milk Fat: Keep Up with Genetic Potential

Milk fat yield continues to rise year on year thanks first to better genetics, which results in ongoing diet design challenges.

Penn State’s Dr. Kevin Harvatine highlights nutrition factors to keep up with the current and future dairy cows.

Targeted Fatty Acid Supplementation

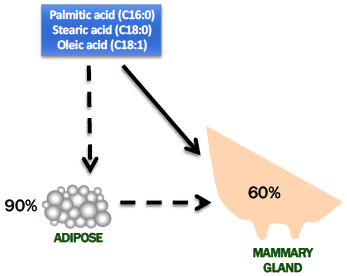

Get Results with Targeted Fatty Acids

“A bag of fat is not just a bag of fat,” says Michigan State’s Dr. Adam Lock.

“You cannot know what to expect from feeding it without — at minimum — knowing its fatty acid profile.”

Recent research shows positive results in the transition period and carry-over into peak lactation with targeted feeding of palmitic (C16:0) and oleic (C18:1) acid blends.

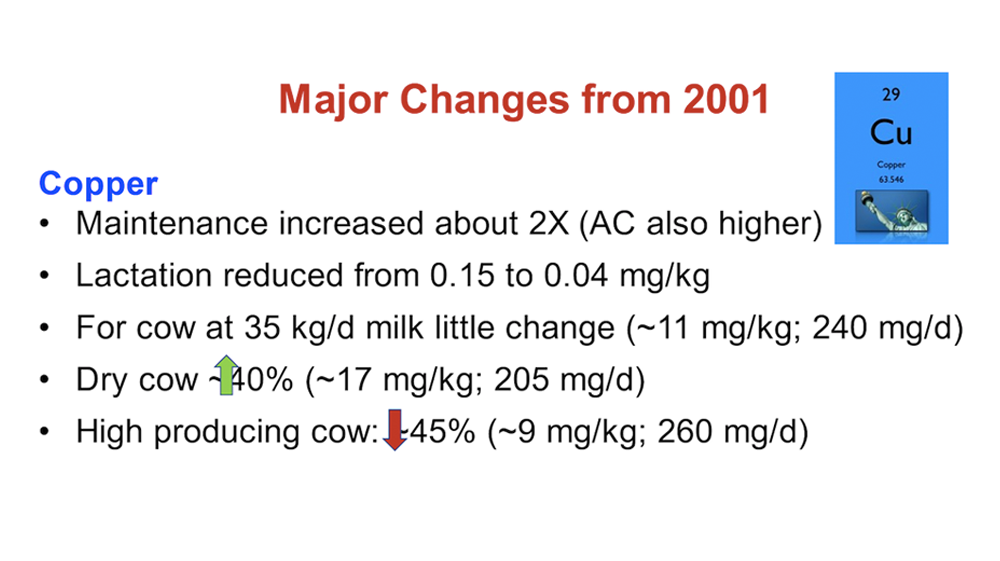

Careful with Copper: More for Maintenance, Avoid Too Much in Lactation

Careful with Copper: More for Maintenance, Avoid Too Much in Lactation. Dr. Weiss says that copper (Cu) supplementation warrants special attention. The main concern is the risk of liver toxicity resulting from over-supplementation in lactation diets.

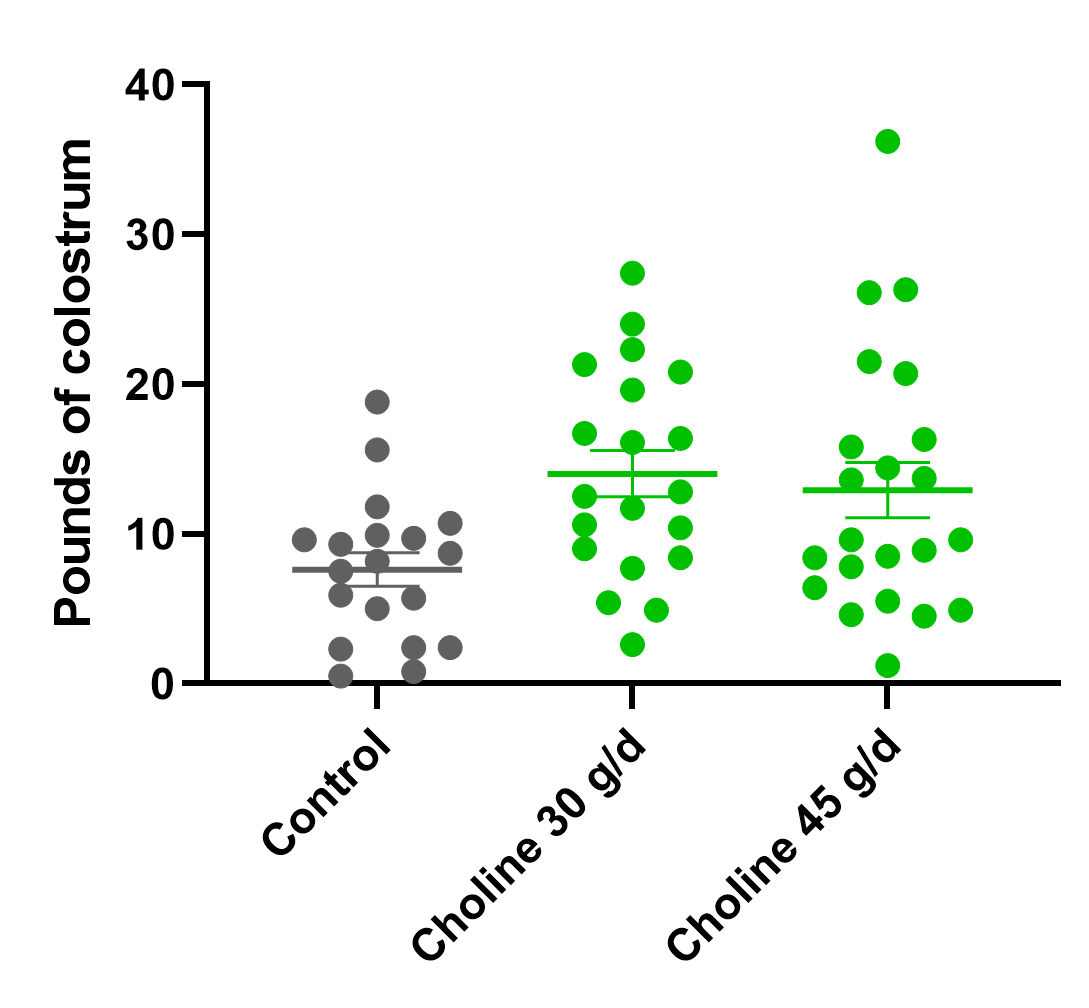

Colostrum Challenge: Choline vs. Seasonal Drop

By late October, many dairy operations experience a decline in colostrum supply, which is critical to the health of newborn calves as their primary source of passive immunity. This seasonal decline varies greatly by farm, by cow, and by other factors, but correlates with lessening daylight. Shorter days, less colostrum.

Cow Data That Keeps Coming

Cows themselves can inform diet formulation on an ongoing basis. One result is rethinking crude protein as a metric for diet formulation, says Cornell’s Dr. Mike Van Amburgh.

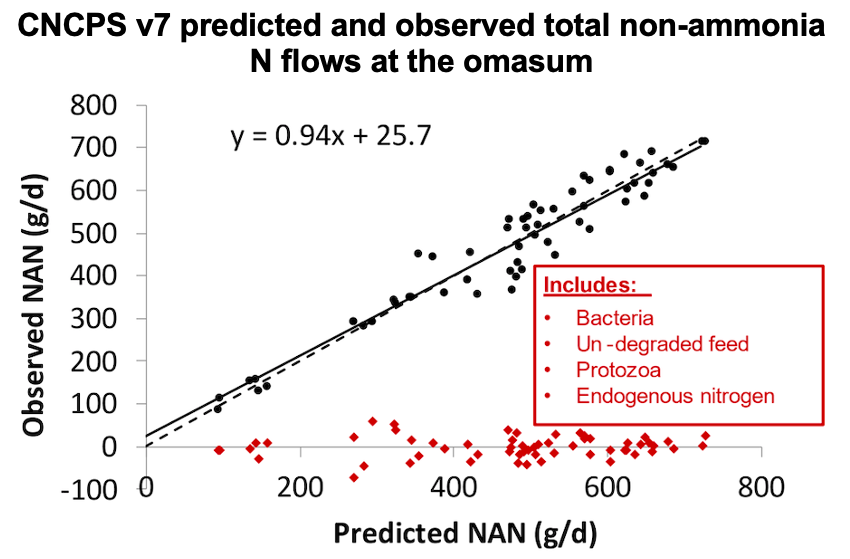

CNCPS v7: Attention to AA & protozoa

The current commercially licensed versions of the Cornell Net Carbohydrate and Protein System (CNCPS v6.5.5 ), refined over more than 30 years, are key to optimal diets used by dairy nutritionists and ration formulators worldwide for millions of cows worldwide.