Market Intel

A Bridge Not Too Far…

Chinese companies own and operate ports near both the Atlantic and Pacific entrances to the Panama Canal. More than 40% of U.S. ocean shipping container traffic reportedly passes through the canal, including a large volume of Asia-sourced feed ingredients headed to the U.S., including vitamins, trace minerals, amino acids, palm products, etc.

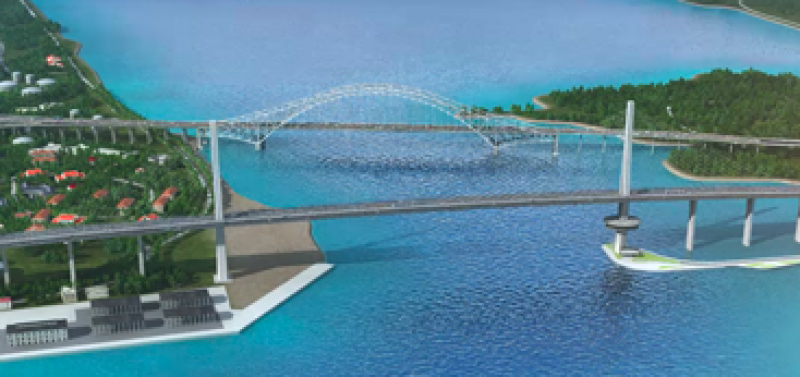

Now, the newest canal bridge — owned by Panama but still under construction by a Chinese consortium — is becoming a major U.S. trade and security concern.

Artist’s image of new bridge in foreground showing existing Bridge of the Americas in background with Pacific Ocean beyond. Courtesy Pedelta, Inc.

Recent U.S. Senate hearings highlighted the bipartisan concern. Panama has administered and will continue to administer the canal responsibly for world trade, the country’s president has stated, including for the U.S.

In other news…

- Canada and Mexico — at this writing — under threat of 25% import tariffs, which would affect many segments of U.S. agriculture

- Looming China import tariffs — 10% threatened — potentially impacting micro ingredient costs

- Decent South American soybean harvest underway in northern regions, dry weather concerns further south

- New immigration rules and enforcement accelerating dairy “robotization”

- East and Gulf Coast port dockworkers strike averted, avoiding disruption of containerized imports, including feed ingredients

Soybean meal: Basis is weakening, although board prices are moving sideways with Market Intel sources suggesting crushers are coping with poor margins. Soy products basis is moving down in step with SBM.

Canola meal: Basis is steady to weaker and board steady to higher. Import tariff uncertainty is causing variable effects.

Amino acids: The global market remains quiet overall, although typical Chinese New Year supply disruptions may yet be a factor. Threonine continues to be in tight supply but more available with steady pricing. Rumen-protect methionine supplies are tight while DL methionine, lysine, and tryptophan are readily available.

Vitamins: Vitamin prices are steady but, according to sources, starting to come down with ranges more in balance with inventories. Despite Chinese New Year, prices of E and A are weaking while D3 prices remain firm.

Trace minerals: Generally quiet markets exist overall with copper sulfate pricing lower than the end of 2024. Sources suggest zinc sulfate pricing is probably at its near-term peak and ready to come down.

P & K: Phosphate prices are up a bit again along with potassium chloride (KCl). Now there’s plenty of magnesium oxide (MgO) with steady prices. Questions persist about imported “magox” quality, encouraging use of domestic products.

Wheat midds: Demand is finally softening per Market Intel sources resulting in lower spot market prices — not quite a typical “post-holiday slide.”

Blood meal: Prices are steady and sources look forward to a decline later this month and into March.

Distillers: DDGS prices are up again across the board, which sources attribute to poor crush margins (like SBM). The creep up may continue as “old crop” (2023 harvest) corn still in bin bottoms may be contaminated with mycotoxin and may have to be blended with 2024 corn.

Soy hulls: Demand persists, especially among Tri-State dairy producers, but sources suggest the price tipping point approaches.

Urea: Prices are up strongly now as reports put U.S. purchases roughly 300,000 tons behind this time a year ago. Meanwhile, other buyers, including India, have been buying on schedule.

Palm & bypass fat products: Palm products prices are lower — finally! — while calcium salt Q2 and Q3 prices are up. Palm buyers are nervous looking ahead into Q3 due to multiple variables — ocean freight, tariffs, and the “Canal factor.”

Over the horizon… Still three-quarters of the new administration’s “first 100 days” ahead.